One of the first steps was to build and launch a new Paraplanning Services offering with the goal of helping advisors, especially those with smaller practices, reduce time they need to spend on completing a financial plan. To meet that need, Jambusaria said, “We’re working on building out a set of services that helps our advisors be able to expand their value proposition more effectively.” LPL Launches Paraplanning ServicesĪneri Jambusaria, executive vice president of LPL’s Planning & Advice Services, was recently quoted in a ThinkAdvisor article discussing the increasing demand from advisors for broader financial planning, tax planning, and estate planning services. Women also represent 33% of LPL’s board, unchanged from 2020.įinancial Advisor IQ also pointed out that the percentage of Hispanic or Latino employees at LPL dropped from 8% in 2020 to 7% in 2021, while Asian employees represented 12% of the firm's workforce last year, down from 13% in 2020. Other areas of improvement: Women comprised 48% of LPL’s workforce in 2021, up from 46% in 2020, while black employees made up 17%, up from 16% in 2020. Currently, 17% of advisors associated with LPL are women, and area that the firm is focused on growing. This council meets three times a year to find ways to attract more underrepresented financial advisors, help advisors address barriers to growth and cultivate inclusive communities for advisors. For example, the article pointed out that on LPL’s 21-advisor Advisor Inclusion Council, 52% are women financial advisors and 51% are advisors of color. Last month, LPL launched its 2022 Sustainability Report, which showcased growth in sustainable investing, work done by the LPL Financial Foundation, which focuses on advancing the economic well-being of underserved populations, and its dedication to diversity and inclusion, highlighted by a whopping 75 percent of its 2021 interns identifying as a woman or person of color.įinancial Advisor IQ focused specifically on how LPL is moving the needle on diversity in some areas, and where it slipped slightly. LPL’s Commitment to Sustainability and Diversity Keeler and Rouch are forming their new Casper, Wyoming-based independent practice, Platte River Private Wealth, also reported by . LPL’s Strategic Wealth Services is adding brothers-in-law Chad Keeler and Brock Rouch to its platform.Wisconsin-based father/daughter advisory duo Robert Viau and Liz Mengo, who are affiliating with LPL's breakaway platform under the name Northern Lakes Financial Group, as reported by.Mitchell Team, powered by LPL Financial, is joining LPL from Stifel, as reported by. North Carolina–based advisor Robert Mitchell, whose R.B.Here’s why she made the move from Morgan Stanley: “We were especially drawn to the Linsco model, which allows us to do everything we could do at a large regional firm, but comes with individualized support and resources.” That’s exactly what Cedar Rapids, Iowa-based Lisa Tesar was looking for.Īs reported by Financial Advisor IQ, Tesar has joined Linsco under the name Tesar Group Investment & Financial Planning at LPL Financial. Linsco by LPL Financial, LPL’s employee model, continues to attract advisors who are unwilling to go fully independent, yet want more flexibility and ownership than the wirehouses offer.

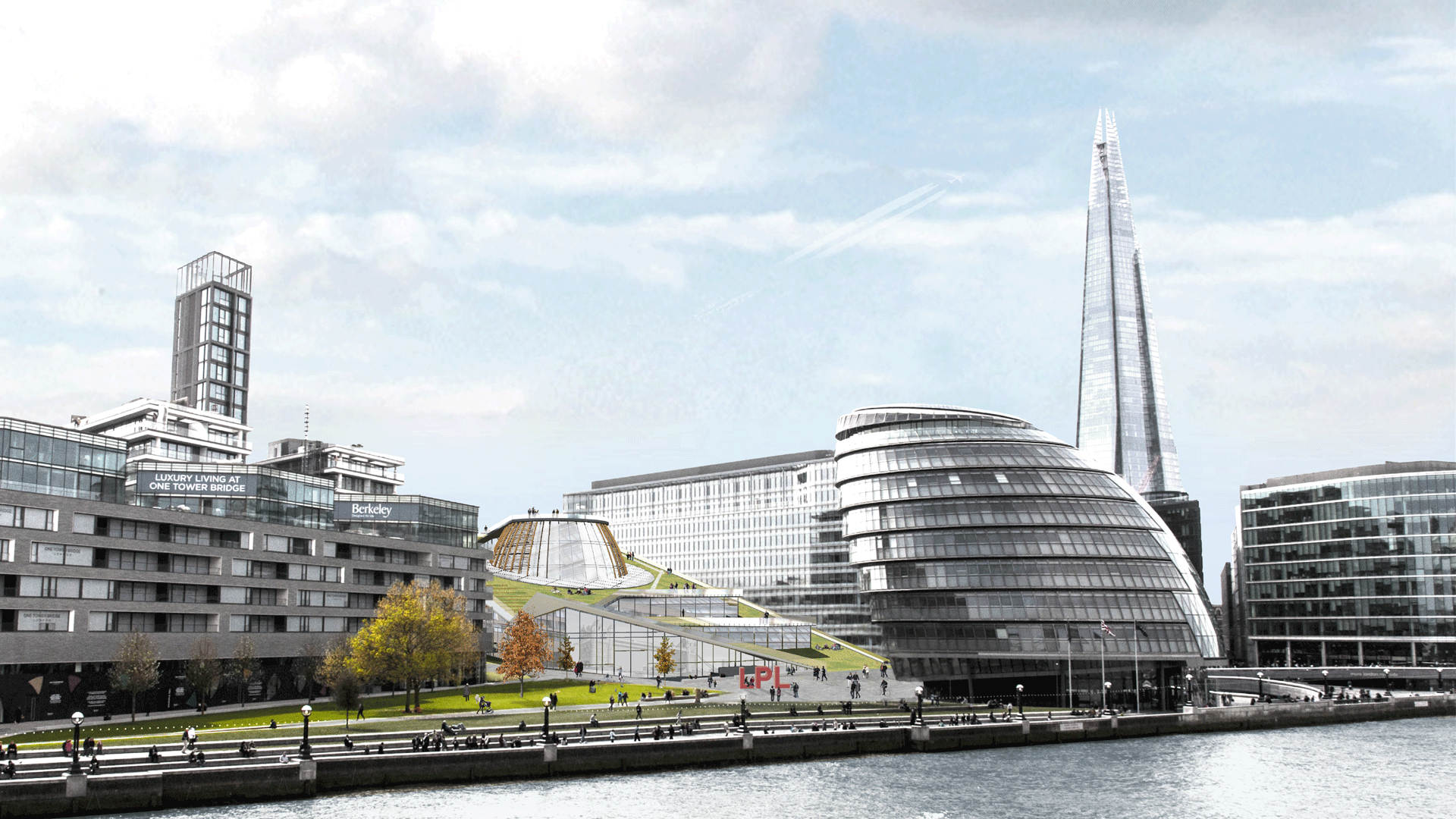

LPL ILIBRARY SHANGHAI FULL

Read the full article to discover more about Charles Zhang, including Zhang’s investment strategy, competitive edge, and what keeps him up at night. equity market has the potential to grow over the next 10 years. at age 21 to attend Western Michigan University, and according to the Forbes article, attributes some of his success to the best advice he’s ever received: “Quitters never win, winners never quit.” He also said that he places a premium on picking the right clients, ones that are interested in building relationships and who are enjoyable to work with.Īnd his investment outlook? While he agrees with many analysts that the next year-plus may be difficult, he’s bullish that the U.S. He grew up in Shanghai and came to the U.S. Zhang, who has been an independent advisor with LPL for more well over a decade, has been recognized for his growth and firm size, currently managing $4.1 billion in assets.

In early April, Charles Zhang, founder and president of Portage, Michigan-based Zhang Financial, was profiled in Forbes. Discover how Charles Zhang built his multi-billion-dollar firm, what notable firms recently joined LPL, and how LPL is raising the bar by investing in sustainability and by delivering a new offering.

0 kommentar(er)

0 kommentar(er)